Spend Analytics Software Market 2022 - Current Trends Competitive Landscape, Sales, Share, Segments, New

[182 Pages Report] The spend analytics market size is expected to grow from USD 1.33 Billion in 2017 to USD 3.01 Billion by 2022, at a Chemical compound Annual Growth Rate (CAGR) of 17.seven%. The report segments the marketplace by component, awarding, analytics type, business concern function, deployment model, arrangement size, vertical, and region. The major growth drivers of the market include increasing need for supplier and market intelligence, predictive analytics for businesses, demand to meliorate manage internal compliance policies and external contracts, and growing demand for cloud calculating technology. The base year considered for this report is 2016, and the market place forecast period is 2017�2022.

Objectives of the Report

The master objective of the study is to ascertain, describe, and forecast the global spend analytics market on the basis of component, application, analytics type, concern function, deployment model, system size, vertical, and region. The report provides detailed information regarding the major factors influencing the growth of the market place (drivers, restraints, opportunities, and manufacture-specific challenges). The written report aims to strategically analyze micromarkets with respect to individual growth trends, hereafter prospects, and contributions to the full market place. The written report attempts to forecast the marketplace size with respect to five main regions, namely, North America, Europe, Asia Pacific (APAC), Middle Eastward and Africa (MEA), and Latin America. The report strategically profiles primal players and comprehensively analyzes their core competencies. It too tracks and analyzes competitive developments, such as partnerships, collaborations, and agreements; mergers and acquisitions; new product developments; and Inquiry and Development (R&D) activities in the market.

Enquiry Methodology

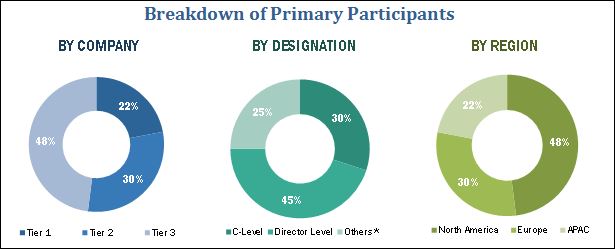

The research methodology used to approximate and forecast the spend analytics market begins with capturing data on key vendor revenues through secondary research, which includes directories and databases (D&B Hoovers, Bloomberg Businessweek, and Factiva). The vendor offerings have likewise been taken into consideration to determine the market sectionalisation. The bottom-upward procedure was employed to arrive at the overall market size of the global market that was derived from the revenue of the key players in the marketplace. After arriving at the overall market size, the full marketplace was separate into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with primal people, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakup procedures were employed to complete the overall marketplace technology process and go far at the exact statistics for all segments and subsegments. The breakdown of profiles of primary participants is depicted in the effigy below:

To know about the assumptions considered for the written report, download the pdf brochure

The spend analytics ecosystem comprises vendors such as SAP SE (Federal republic of germany), SAS Institute, Inc. (Usa), IBM Corporation (U.s.a.), Oracle Corporation (US), Coupa Software Inc. (US), Zycus Inc. (U.s.), Proactis (UK), Empronc Solutions Pvt. Ltd. (Bharat), JAGGAER (US), Rosslyn Analytics, Ltd. (Britain), Ivalua Inc. (US), and BravoSolution SPA (United states of america). Other stakeholders of the spend analytics market include spend analytics vendors, enquiry organizations, network and system integrators, spend analytics managed service providers, Concern Intelligence (BI) solution providers, marketing analytics executives, predictive analytics providers, third-party providers, and technology providers.

Spend Analytics Central Target Audience:

- Service providers and distributors

- Spend analytics application builders

- Independent Software Vendors (ISVs)

- Analytics consulting companies

- Enterprises

- Cease-users

�The study answers several questions for the stakeholders, primarily which market segments to focus on in the next ii�5 years for prioritizing efforts and investments.�

Get online admission to the report on the Earth's First Marketplace Intelligence Cloud

- Piece of cake to Download Historical Data & Forecast Numbers

- Visitor Analysis Dashboard for high growth potential opportunities

- Inquiry Analyst Access for customization & queries

- Competitor Assay with Interactive dashboard

- Latest News, Updates & Trend assay

Request Sample

Telescopic of the Report

The inquiry report categorizes the spend analytics market to forecast the revenues and analyze trends in each of the following subsegments:

By Application

- Financial direction

- Risk management

- Governance and compliance direction

- Supplier sourcing and performance management

- Demand and supply forecasting

- Others (product and process management, inventory management, and category analysis)

By Component

- Software

- Services

- Managed services

- Professional person services

- Consulting services

- Support and maintenance

By Analytics Blazon

- Predictive

- Prescriptive

- Descriptive

By Concern Function

- Finance

- Data Engineering science (IT)

- Marketing

- Procurement

By Deployment Model

- On-premises

- Cloud

Past Organisation Size

- Minor and Medium Enterprises (SMEs)

- Big enterprises

Past Industry Vertical

- Manufacturing

- Retail and eCommerce

- Authorities and defense force

- Healthcare and life sciences

- Telecommunication and Information technology

- Energy and utilities

- Banking, Fiscal Services, and Insurance (BFSI)

- Others (construction, real estate, and education)

By Region

- North America

- Europe

- APAC

- Latin America

- MEA

Available Customizations

With the given market place data, MarketsandMarkets offers customizations as per the company�s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the North American spend analytics market

- Further breakdown of the European market place

- Further breakdown of the APAC market

- Farther breakup of the Latin American market

- Further breakdown of the MEA marketplace

Company Information

- Detailed analysis and profiling of boosted market players

The spend analytics market place is expected to grow from USD one.33 Billion in 2017 to USD 3.01 Billion by 2022, at a Chemical compound Almanac Growth Rate (CAGR) of 17.7%. Factors such as increasing need for supplier and market intelligence, predictive analytics for businesses, need to better manage internal compliance policies and external contracts, and growing demand for cloud computing applied science are driving the global market.

The report provides detailed insights into the global spend analytics market, which is segmented by application, component, analytics type, business organization part, deployment model, organization size, vertical, and region.

In the component segment, spend analytics software segment is expected to have the largest market share during the forecast period. The need for spend analytics software is rising every bit organizations are looking for solutions to obey strict governance and compliance policies related to their accounts and spend data, increasing adoption of market intelligence past suppliers, and the necessity to proceed visitor�s expenditure to the minimum without affecting its operations.

Among applications, financial management is expected to continue its dominance during the forecast period. In order to bridge the gap between financial performance and operational performance, organizations are adopting spend analytics software and services.

The cloud deployment model is expected to showroom a higher adoption, compared to the on-premises deployment model. The need for deject-driven Awarding Plan Interfaces (APIs) is rising among customers, which in turn is supporting the growth of cloud-based deployment models.

The Retail & eCommerce vertical is expected to found the largest marketplace share and continue to lead the market during the forecast period. The need to generate insights from spend data past organizations in supplier functioning management, working capital performance, parts standardization, and sourcing strategy evolution is expected to foster the demand in this vertical.

Large enterprises dominate the marketplace in terms of revenue generation with the widespread adoption of spend analytics for various applications, such as governance and compliance management, and adventure management. Withal, Pocket-sized and Medium-Sized Enterprises (SMEs) are expected to exhibit the highest CAGR owing to easy availability and scalability of cloud-based deployments.

The descriptive analytics type segment is growing at the fastest CAGR due to the increasing adoption of digital technologies and the demand for analytics to determine the crusade of events and behaviors related to spend information.

The marketing business function is expected to grow at the highest CAGR, equally organizations need to assemble and analyze spend data from disparate sources, such as marketing, sales, and CRM systems, to become a holistic view and real-time insights into the effectiveness of their marketing campaigns.

The study covers all the major aspects of the spend analytics market and provides an in-depth assay across the regions of Northward America, Europe, Asia Pacific (APAC), Middle E and Africa (MEA), and Latin America. North America, attributable to the early adoption of new and emerging technologies and the presence of major industry players, is expected to continue to dominate the market throughout the forecast period. The APAC region is expected to abound at the highest CAGR during the forecast period, attributable to the growing adoption of price-effective spend analytics software and services among SMEs.

The challenges faced past the spend analytics market are bug in achieving consistency in business semantics and interpretations, data privacy and security concerns, and concerns virtually positive Render on Investment (RoI). Difficulty in migrating from legacy systems might restrain the market growth.

The global spend analytics market is fragmented in nature, as no single vendor dominates the market. Major vendors that offering spend analytics solutions include SAP SE (Germany), SAS Institute, Inc. (United states of america), IBM Corporation (US), Oracle Corporation (U.s.), Coupa Software Inc. (United states of america), Zycus Inc. (US), Proactis (UK), Empronc Solutions Pvt. Ltd. (Republic of india), JAGGAER (United states), Rosslyn Analytics, Ltd. (United kingdom of great britain and northern ireland), Ivalua Inc. (The states), and BravoSolution SPA (U.s.). These vendors have adopted unlike types of organic and inorganic growth strategies, such as new production launches, partnerships and collaborations, and mergers and acquisitions, to aggrandize their offerings in the market place.

To speak to our annotator for a discussion on the above findings, click Speak to Analyst

Table of Contents

one Introduction (Page No. - 17)

1.1 Objectives of the Report

1.ii Market Definition

ane.iii Marketplace Scope

i.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Inquiry Methodology (Folio No. - 21)

ii.1 Research Information

2.1.1 Secondary Data

2.1.ii Primary Data

2.1.2.1 Breakdown of Primaries

2.i.2.2 Central Industry Insights

2.ii Market Size Estimation

2.3 Microquadrant Research Methodology

2.4 Research Assumptions

2.5 Limitations

3 Executive Summary (Folio No. - 29)

4 Premium Insights (Folio No. - 35)

4.1 Attractive Opportunities in Spend Analytics Market

iv.2 Market Share, By Region

4.three Market By Vertical and Region

4.4 Life Cycle Analysis, By Region, 2017

5 Market Overview and Industry Trends (Page No. - 39)

v.1 Marketplace Overview

5.1.1 Introduction

5.1.2 Market place Dynamics

5.1.3 Drivers

5.i.3.ane Increasing Need for Supplier and Market Intelligence

5.1.3.2 Predictive Analytics for Businesses

5.i.3.iii Need to Meliorate Manage Internal Compliance Polices and External Contracts

5.1.4 Restraints

5.ane.iv.1 Difficulty in Migrating From Legacy Systems

5.i.five Opportunities

5.1.5.ane Rise in Mobile Applications

5.1.5.2 Growing Demand for Cloud Computing Technology

5.1.half-dozen Challenges

five.1.6.one Lack of Standardized Process

5.one.six.2 Large Number of Information Sources

5.ii Industry Trends

5.two.1 Marketplace: Utilise Cases

5.ii.1.1 Introduction

5.2.1.2 Use Case 1: Manufacturing

5.2.1.three Employ Case ii: Agriculture

5.2.1.four Employ Case three: Educational activity

5.2.i.v Use Instance 4: Outsourcing/Offshoring

five.2.1.6 Use Case 5: Education

5.3 Spend Analytics Procedure

5.iv Technologies in Market

5.4.1 Large Data

5.4.two Artificial Intelligence

5.4.3 Deject Computing

5.iv.4 Advanced Analytics

five.4.five Business Intelligence (BI)

6 Spend Analytics Market place Assay, By Application (Page No. - l)

6.ane Introduction

6.2 Financial Management

vi.iii Hazard Management

6.4 Governance and Compliance Management

6.5 Supplier Sourcing and Performance Management

6.6 Demand and Supply Forecasting

half dozen.7 Others

7 Spend Analytics Market Analysis, Past Component (Page No. - 58)

seven.1 Introduction

7.2 Software

seven.three Services

seven.3.1 Managed Services

7.3.ii Professional Services

vii.iii.iii Support and Maintenance

7.3.4 Consulting

eight Spend Analytics Market Analysis, By Analytics Type (Page No. - 66)

8.1 Introduction

8.2 Predictive Analytics

8.3 Prescriptive Analytics

viii.iv Descriptive Analytics

9 Spend Analytics Marketplace Analysis, By Concern Function (Page No. - 71)

ix.1 Introduction

nine.2 Finance

nine.3 Information technology (Information technology)

9.four Marketing

9.5 Procurement

10 Spend Analytics Marketplace Assay, By Deployment Model (Page No. - 76)

10.ane Introduction

ten.two On-Premises

10.3 Cloud

11 Spend Analytics Marketplace Analysis, Past Organization Size (Folio No. - eighty)

11.1 Introduction

11.2 Small and Medium-Sized Businesses (SMBS)

11.three Large Enterprises

12 Spend Analytics Market Analysis, By Vertical (Page No. - 84)

12.1 Introduction

12.two Manufacturing

12.3 Retail and Ecommerce

12.iv Government and Defense force

12.five Healthcare and Life Sciences

12.6 Telecommunication and IT

12.vii Cyberbanking, Financial Services, and Insurance (BFSI)

12.8 Energy and Utilities

12.9 Others

13 Geographic Analysis (Page No. - 93)

thirteen.1 Introduction

13.ii North America

13.3 Europe

13.4 APAC

xiii.five Center E and Africa (MEA)

xiii.half-dozen Latin America

fourteen Competitive Landscape (Page No. - 118)

xiv.one Microquadrant Overview

xiv.1.1 Vanguards

14.i.2 Innovators

14.ane.3 Dynamic

14.1.4 Emerging

14.2 Competitive Benchmarking

14.2.ane Concern Strategies Adopted By Major Players in Spend Analytics Marketplace

14.2.2 Analysis of Product Portfolio of Major Players in Spend Analytics Marketplace

15 Company Profiles (Folio No. - 122)

(Business Overview, Production Offerings & Concern Strategies, Key Insights, Contempo Developments, MnM View)*

fifteen.ane SAP

15.2 SAS Institute

xv.iii IBM

xv.four Oracle

15.5 Coupa Software

15.half dozen Zycus

15.7 Proactis

fifteen.8 Empronc Solutions

15.9 Jaggaer

15.x Rosslyn Data Technologies

15.xi Ivalua

15.12 Bravosolution

*Details on Business Overview, Product Offerings & Business Strategies, Fundamental Insights, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

16 Appendix (Page No. - 173)

16.1 Cardinal Insights of Manufacture Experts

16.2 Word Guide

16.iii Cognition Store: Marketsandmarkets� Subscription Portal

sixteen.4 Introducing RT: Real-Time Market place Intelligence

16.5 Bachelor Customizations

16.half-dozen Related Reports

16.7 Author Details

List of Tables (90 Tables)

Tabular array 1 USD Commutation Rate, 2014�2016

Table 2 Evaluation Criteria

Table 3 Spend Analytics Market Size and Growth, 2017�2022 (USD One thousand thousand, Y-O-Y %)

Table 4 Market place Size By Application, 2015�2022 (USD Million)

Tabular array 5 Fiscal Management Awarding: Market Size, Past Region, 2015�2022 (USD Million)

Table vi Risk Direction Application: Marketplace Size, By Region, 2015�2022 (USD Million)

Table seven Governance and Compliance Management Application: Market place Size, By Region, 2015�2022 (USD Million)

Table 8 Supplier Sourcing and Performance Management Awarding: Market place Size, By Region, 2015�2022 (USD One thousand thousand)

Table 9 Need and Supply Forecasting Awarding: Market Size, By Region, 2015�2022 (USD 1000000)

Table 10 Others Awarding Segment: Market place Size, By Region, 2015�2022 (USD Meg)

Table 11 Spend and Procurement Analytics Market Size, By Component, 2015�2022 (USD Million)

Table 12 Software: Market Size, By Region, 2015�2022 (USD Million)

Table xiii Services: Market Size, Past Region, 2015�2022 (USD 1000000)

Table 14 Services: Market Size, Past Blazon, 2015�2022 (USD One thousand thousand)

Tabular array 15 Managed Services: Marketplace Size, By Region, 2015�2022 (USD Million)

Table 16 Professional person Services: Market Size, Past Region, 2015�2022 (USD Million)

Table 17 Professional person Services: Market Size, By Type, 2015�2022 (USD Million)

Table 18 Support and Maintenance: Professional Services Market place Size, By Region, 2015�2022 (USD Million)

Table xix Consulting Services: Professional Services Market Size, By Region, 2015�2022 (USD Million)

Table 20 Spend Analytics Market Size, By Analytics Type, 2015�2022 (USD Million)

Table 21 Predictive Analytics: Market place Size, By Region, 2015�2022 (USD Million)

Table 22 Prescriptive Analytics: Market place Size, Past Region, 2015�2022 (USD One thousand thousand)

Tabular array 23 Descriptive Analytics: Marketplace Size, By Region, 2015�2022 (USD Meg)

Table 24 Spend Analytics Market Size, By Business Function, 2015�2022 (USD Million)

Table 25 Finance Business Function: Marketplace Size, By Region, 2015�2022 (USD Million)

Tabular array 26 It Business Function: Market place Size, By Region, 2015�2022 (USD Million)

Table 27 Marketing Business concern Function: Market Size, Past Region, 2015�2022 (USD One thousand thousand)

Table 28 Procurement Business organization Function: Market Size, By Region, 2015�2022 (USD Million)

Tabular array 29 Spend and Procurement Analytics Marketplace Size, By Deployment Model, 2015�2022 (USD Million)

Table thirty On-Premises Deployment Model: Market Size, By Region, 2015�2022 (USD Million)

Table 31 Cloud Deployment Model: Market Size, By Region, 2015�2022 (USD 1000000)

Table 32 Spend and Procurement Analytics Market Size, By Organization Size, 2015�2022 (USD Million)

Table 33 SMBS: Market Size, By Region, 2015�2022 (USD 1000000)

Table 34 Large Enterprises: Market Size, By Region, 2015�2022 (USD Million)

Table 35 Spend Analytics Market Size, Past Vertical, 2015�2022 (USD Million)

Table 36 Manufacturing Vertical: Marketplace Size, Past Region, 2015�2022 (USD Meg)

Table 37 Retail and Ecommerce Vertical: Market Size, By Region, 2015�2022 (USD Million)

Table 38 Regime and Defense Vertical: Market Size, Past Region, 2015�2022 (USD Million)

Table 39 Healthcare and Life Sciences Vertical: Marketplace Size, By Region, 2015�2022 (USD Million)

Table 40 Telecommunications and IT Vertical: Market Size, Past Region, 2015�2022 (USD Million)

Table 41 BFSI Vertical: Market Size, By Region, 2015�2022 (USD 1000000)

Tabular array 42 Energy and Utilities Vertical: Market Size, Past Region, 2015�2022 (USD Million)

Table 43 Others Vertical: Marketplace Size, Past Region, 2015�2022 (USD 1000000)

Table 44 Spend Analytics Market Size, By Region, 2015�2022 (USD Million)

Tabular array 45 Due north America: Market Size, By Component, 2015�2022 (USD One thousand thousand)

Table 46 North America: Market place Size, By Service, 2015�2022 (USD Million)

Tabular array 47 N America: Spend and Procurement Analytics Professional Services Market Size, By Type, 2015�2022 (USD Million)

Table 48 N America: Spend Analytics Market Size, Past Application, 2015�2022 (USD Million)

Table 49 North America: Market Size, By Analytics Type, 2015�2022 (USD Million)

Table 50 North America: Market Size, By Business organization Part, 2015�2022 (USD 1000000)

Table 51 Northward America: Market place Size, Past Deployment Model, 2015�2022 (USD Million)

Table 52 North America: Market Size, Past Organization Size, 2015�2022 (USD Million)

Table 53 North America: Market place Size, By Vertical, 2015�2022 (USD Million)

Table 54 Europe: Spend Analytics Market place Size, By Component, 2015�2022 (USD Million)

Table 55 Europe: Market Size, Past Service, 2015�2022 (USD One thousand thousand)

Table 56 Europe: Spend and Procurement Analytics Professional person Service Market Size, By Type, 2015�2022 (USD Million)

Table 57 Europe: Market Size, By Awarding, 2015�2022 (USD Meg)

Table 58 Europe: Marketplace Size, By Analytics Type, 2015�2022 (USD 1000000)

Tabular array 59 Europe: Market Size, By Concern Part, 2015�2022 (USD Meg)

Tabular array threescore Europe: Marketplace Size, By Deployment Model, 2015�2022 (USD Million)

Table 61 Europe: Market Size, By Organization Size, 2015�2022 (USD One thousand thousand)

Table 62 Europe: Spend Analytics Market Size, By Vertical, 2015�2022 (USD Million)

Table 63 APAC: Market Size, By Component, 2015�2022 (USD Million)

Tabular array 64 APAC: Market Size, Past Service, 2015�2022 (USD Million)

Table 65 APAC: Spend and Procurement Analytics Professional person Service Marketplace Size, By Blazon, 2015�2022 (USD One thousand thousand)

Table 66 APAC: Market place Size, Past Application, 2015�2022 (USD Million)

Table 67 APAC: Market Size, Past Analytics Type, 2015�2022 (USD 1000000)

Table 68 APAC: Market Size, By Business organisation Function, 2015�2022 (USD Million)

Tabular array 69 APAC: Spend Analytics Market place Size, Past Deployment Model, 2015�2022 (USD Million)

Table lxx APAC: Market Size, By Organization Size, 2015�2022 (USD Million)

Table 71 APAC: Market Size, By Vertical, 2015�2022 (USD Million)

Table 72 MEA: Marketplace Size, Past Component, 2015�2022 (USD 1000000)

Tabular array 73 MEA: Market place Size, By Service, 2015�2022 (USD Meg)

Table 74 MEA: Spend and Procurement Analytics Professional Service Market Size, By Type, 2015�2022 (USD Million)

Table 75 MEA: Market Size, By Application, 2015�2022 (USD Million)

Tabular array 76 MEA: Marketplace Size, By Analytics Type, 2015�2022 (USD Million)

Table 77 MEA: Market place Size, By Business organisation Office, 2015�2022 (USD Million)

Table 78 MEA: Market Size, By Deployment Model, 2015�2022 (USD Meg)

Table 79 MEA: Market Size, Past Organization Size, 2015�2022 (USD Million)

Table 80 MEA: Market Size, By Vertical, 2015�2022 (USD Meg)

Table 81 Latin America: Spend Analytics Market Size, By Component, 2015�2022 (USD Meg)

Table 82 Latin America: Market Size, By Service, 2015�2022 (USD 1000000)

Tabular array 83 Latin America: Spend and Procurement Analytics Professional Service Market Size, By Type, 2015�2022 (USD Million)

Tabular array 84 Latin America: Market Size, By Awarding, 2015�2022 (USD One thousand thousand)

Table 85 Latin America: Market Size, By Analytics Blazon, 2015�2022 (USD Meg)

Tabular array 86 Latin America: Market Size, Past Business organisation Function, 2015�2022 (USD Million)

Table 87 Latin America: Market place Size, By Deployment Model, 2015�2022 (USD Million)

Tabular array 88 Latin America: Marketplace Size, By Organization Size, 2015�2022 (USD Meg)

Table 89 Latin America: Market Size, By Vertical, 2015�2022 (USD Million)

Tabular array 90 Market Ranking for Spend and Procurement Analytics Market, 2017

Listing of Figures (67 Figures)

Effigy 1 Spend Analytics Market Division

Figure 2 Market place Enquiry Design

Figure three Breakup of Master Interviews: By Visitor, Designation, and Region

Figure iv Data Triangulation

Effigy 5 Market place Size Interpretation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Spend Analytics Market: Assumptions

Figure eight Better Management of Compliance and Predictive Analytics to Drive Growth of Spend and Procurement Analytics Marketplace (USD One thousand thousand)

Effigy 9 Market Snapshot By Component (2017 vs 2022)

Figure ten Market place Snapshot By Service (2017 vs 2022)

Figure eleven Market Snapshot By Application (2017�2022)

Figure 12 Market Snapshot By Deployment Model (2017� 2022)

Effigy 13 Spend and Procurement Analytics Market Snapshot, By Analytics Type (2017� 2022)

Figure fourteen Market Snapshot By Business organization Function (2017�2022)

Effigy 15 Marketplace Snapshot By Organization Size (2017�2022)

Figure 16 Market Snapshot By Vertical (2017�2022)

Figure 17 Need to Generate Valuable Insights From Spend Data and Increment in Manufacture-Specific Spend and Procurement Analytics Applications to Drive Market Growth

Figure 18 North America to Agree Largest Market Share in 2017

Effigy nineteen Manufacturing Vertical and North America to Hold Largest Market place Share in 2017

Figure 20 APAC to Tape Exponential Growth During 2017-2022

Figure 21 Spend and Procurement Analytics Market: Drivers, Restraints, Opportunities, and Challenges

Effigy 22 Spend Analytics Process

Figure 23 Risk Direction Application Segment to Record Highest Growth During 2017-2022 (USD Million)

Figure 24 Services Segment to Record Higher Growth During 2017-2022 (USD Million)

Effigy 25 Managed Services to Tape Higher Growth During 2017-2022 (USD Million)

Figure 26 Consulting Services Sub-Segment to Record College Growth During 2017-2022 (USD Million)

Figure 27 Descriptive Analytics Segment to Tape Highest Growth During 2017-2022 (USD One thousand thousand)

Figure 28 Marketing Business Function to Record Highest Growth During 2017-2022 (USD One thousand thousand)

Figure 29 Cloud Deployment Model to Tape Higher Growth During 2017-2022 (USD 1000000)

Figure 30 SMBS Segment to Record Higher Growth During 2017-2022 (USD 1000000)

Figure 31 Energy and Utilities Vertical to Record Highest Growth During 2017-2022 (USD Million)

Figure 32 Global Market Snapshot: APAC to Record Highest Growth During Forecast Period

Effigy 33 APAC Market place to Tape Highest Growth During 2017-2022 (USD Million)

Effigy 34 North America: Spend Analytics Market Snapshot

Figure 35 APAC: Spend Analytics Market Snapshot

Figure 36 Microquadrant

Figure 37 SAP: Visitor Snapshot

Effigy 38 SAP: Product Offering Scorecard

Figure 39 SAP: Business Strategy Scorecard

Figure 40 SAS Institute: Company Snapshot

Effigy 41 SAS Institute: Production Offering Scorecard

Figure 42 SAS Constitute: Business Strategy Scorecard

Figure 43 IBM: Company Snapshot

Effigy 44 IBM: Product Offering Scorecard

Figure 45 IBM: Business Strategy Scorecard

Effigy 46 Oracle: Company Snapshot

Figure 47 Oracle: Production Offering Scorecard

Figure 48 Oracle: Business Strategy Scorecard

Figure 49 Coupa Software: Company Snapshot

Figure l Coupa Software: Product Offering Scorecard

Figure 51 Coupa Software: Business Strategy Scorecard

Figure 52 ZycUS: Production Offering Scorecard

Figure 53 ZycUS: Concern Strategy Scorecard

Effigy 54 Proactis: Company Snapshot

Figure 55 Proactis: Product Offering Scorecard

Figure 56 Proactis: Business Strategy Scorecard

Figure 57 Empronc Solutions: Product Offer Scorecard

Effigy 58 Empronc Solutions: Business Strategy Scorecard

Figure 59 Jaggaer: Product Offering Scorecard

Figure 60 Jaggaer: Business Strategy Scorecard

Effigy 61 Rosslyn Data Technologies: Company Snapshot

Figure 62 Rosslyn Data Technologies: Product Offering Scorecard

Effigy 63 Rosslyn Information Technologies: Business Strategy Scorecard

Effigy 64 Ivalua: Product Offer Scorecard

Figure 65 Ivalua: Concern Strategy Scorecard

Effigy 66 Bravosolution: Product Offering Scorecard

Figure 67 Bravosolution: Concern Strategy Scorecard

Source: https://www.marketsandmarkets.com/Market-Reports/spend-analytics-market-259355881.html

Posted by: maldonadothostiress.blogspot.com

0 Response to "Spend Analytics Software Market 2022 - Current Trends Competitive Landscape, Sales, Share, Segments, New"

Post a Comment